Miss Thrifty2 October 28, 2016

Where were we? Ah yes: pension planning for the financially nerve wracked thirty something, courtesy of Aviva’s new Shape My Future web tool.

There I was, fingers poised over keyboard and mouse, about to find out if the lackadaisical pension planning follies of my youth were about to condemn me to a tap-water sandwich-fuelled retirement.

I began by typing in my date of birth and my sex, so that Shape My Future could calculate when I am likely to retire.

Next, I typed in the amount I earn, the amount paid into my work pension every month and the current size of my pension pot. You’ll need this information to hand: you’ll find it on your monthly payslips, and the latest statement sent to you by your pension provider once a year.

Shape My Future wanted to know if I would own my house outright by the time I retired, and if I had expectations of any additional income once I had signed off and out of work.

As I filled out the form fields, a summary of all the information appeared on the right of my laptop screen, above a strolling lady who looked far more perky than I was feeling.

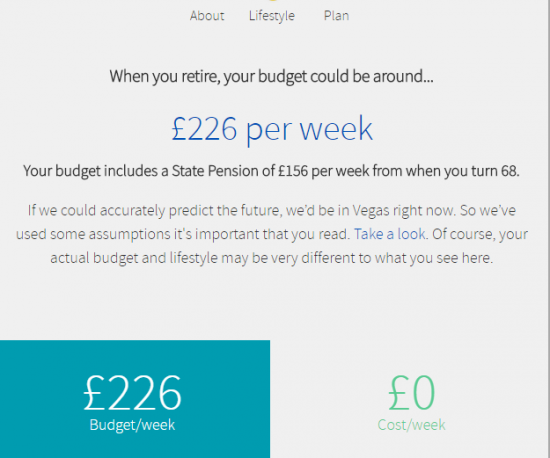

At this stage, the tool added my pot and monthly contributions to the current state pension (£156 a week), and worked out how much income I am likely to receive every week.

Hang on a minute: was that right? £228 every week? With no mortgage to pay? That’s almost a grand a month. Thanks to a frugal lifestyle, I could live off that, couldn’t I?

What worried me, as per my previous post, was that by the time I retire, the state pension may be gone completely. The Shape My Future tool presumes that it will be intact: the tool relies on a lengthy list of presumptions, including the rate of inflation and pension fund management charges. These are spelled out though: the Aviva tool is envisaged as a general guide, rather than a resource with laser-like precision.

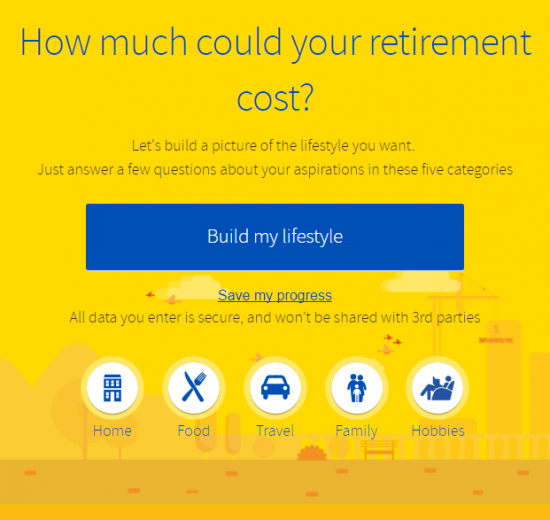

Also, by giving myself a pat on the back that my retirement was going to be better than I had expected, I was getting ahead of the game. The next step was for the Shape My Future tool to analyse my likely outgoings, to calculate if I really could live within my likely means…

The tool quizzed on all aspects of my life and spending, from the size of my accommodation and mobile phone use, to how much I planned to spend on the grandkids at Christmas. Each chunk of outgoings was allocated a multiple choice question, with various lifestyle and expenditure options.

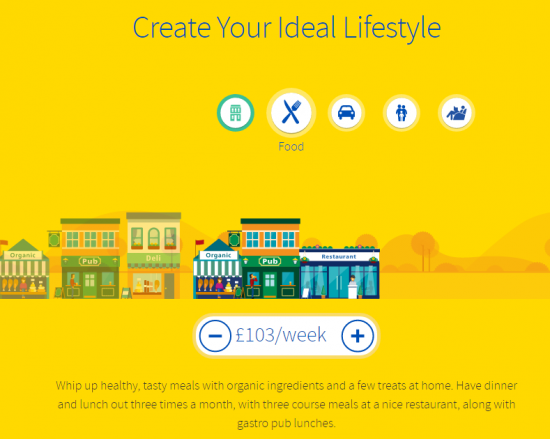

I must admit, I primped and preened a little when asked how much I would spend at the supermarket and on eating out: £28, £45, £54, £66 or £103? That deluxe, £103 option is as follows:

I can do £28, easy.

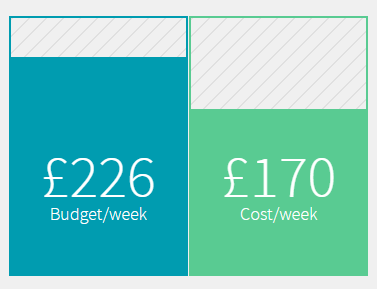

Finally, the tool produced a breakdown of my outgoings – and concluded that I would be in the money (relatively speaking).

I can’t begin to tell you how surprised I was. I thought I would be destitute: instead, I felt like Scrooge McDuck diving into his cash pit.

The mobile version of this tool is very neat, but I would recommend trying this on your laptop or desktop instead. You get a lot more detail, without having to scroll:

So, this was what my old age could look like: a mortgage-free 2-bedroom flat, broadband, Netflix, trips to the park and library with the grandchildren, gifting at Christmas, a weekly exercise class, plenty of hobbies and some money put by every month. I felt like… like… a baby boomer!

On a more serious note, this Shape My Future tool came along at just the right time for me. Although my pension situation turned out to be (possibly) less perilous than I had feared, it forced my hand and encouraged me to take a long, hard, difficult look at my pension plans. It was cathartic and has given me the momentum to work out ways in which I can increase my likely retirement income going forward – in case my fears about the state pension are realised, or in case the stock market crashes just as I collect my carriage clock.

If you are in this situation, Aviva has a good selection of tools and articles on the [Shape My Future hub], which accompanies the tool.

Go on, I dare you: are you brave enough to do what I did and find out if you are going to be old and bold, or old and cold? If you try out the Shape My Future tool, I’d love to know if your envisaged retirement looks anything like mine…

This post was produced in association with Aviva. I was not-so-secretly pleased to have been approached by Aviva to work with them on the Shape My Future project, Partly because they are paying me, but mostly because I really needed a foot up my backside to confront my pension demons. ‘Pension demons’? They must wear bowler hats, right? Anyway, the Aviva Shape my Future tool uses simple inputs to give a basic idea of retirement income. Details of assumptions are available at Aviva.co.uk.

2 Responses to “Pension Planning: Like Ripping Off A Plaster The Size Of Your Entire Body? (Ad Feature)”

Sarah @tortoisehappy.com says:

I know it’s based on a load of assumptions and no one can predict the future, but I’ve not seen such an easy tool for working out what I’ll need in retirement and whether I’m on track for the life I want

October 29, 2016 at 3:33 pm

Miss Thrifty says:

Thanks Sarah – it’s nice and easy, isn’t it? Makes the scary stuff a little less scary, IMO.

November 2, 2016 at 1:58 pm